ประเภทหนัง

ตัวอย่างหนัง Hotbit, Trading Strategy, Take Profit

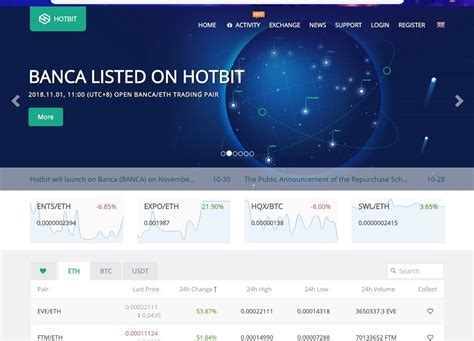

Mastering the Art of Cryptocurrency Trading with Hotbit and a Profitable Strategy

As the world of cryptocurrencies continues to evolve, traders are looking for reliable and profitable strategies to navigate the ever-changing market landscape. One platform that has gained significant attention is Hotbit, a leading cryptocurrency exchange and trading platform. In this article, we delve into the world of crypto trading, explore the benefits of using Hotbit as an exchange, and provide a comprehensive strategy for succeeding in the world of high-stakes cryptocurrency markets.

What is Crypto Trading?

Cryptocurrency trading involves buying and selling digital currencies such as Bitcoin (BTC), Ethereum (ETH), and others on online exchanges. The key to successful crypto trading is understanding market dynamics, identifying trends, and making informed decisions based on real-time data.

Hotbit: A Reliable Cryptocurrency Exchange

Hotbit is an established cryptocurrency exchange that has been in operation since 2016. With a user-friendly interface, robust security measures, and competitive pricing, Hotbit provides an ideal environment for traders to trade quickly and efficiently. Here are some of the key benefits of Hotbit:

- Fast and Secure Transactions: Hotbit’s advanced payment system ensures fast and secure transactions and reduces the risk of exchange hacking.

- Competitive Pricing: Hotbit’s competitive pricing model makes it an attractive option for traders looking to minimize their transaction fees.

- Advanced Security Measures: Hotbit has implemented robust security measures to protect users’ assets and prevent unauthorized access.

A Profitable Crypto Trading Strategy:

Although crypto trading can be highly volatile, there are several strategies that have been proven to increase profitability. Here is a comprehensive strategy for success in the cryptocurrency markets:

- Dollar-Cost Averaging: This strategy involves buying and holding cryptocurrencies at a fixed price, regardless of market conditions. By averaging your investment over a period of time, you can reduce the impact of market fluctuations.

- Position Size: Position sizing is an essential aspect of successful crypto trading. It involves determining the optimal size of each trade based on risk tolerance and market conditions. A general rule of thumb is to use a position size ratio of 1:20 or 1:50, with larger positions having a lower risk-reward ratio.

- Stop-Loss Orders

: Stop-loss orders are important to limit potential losses in the event of a price decline. By setting a stop-loss order at a certain percentage point below your entry price, you can avoid significant losses when the market is volatile.

The Hotbit Trading Strategy:

Here is a sample strategy using Hotbit and some of the techniques above:

- Initial Position: Open a position of 1 Bitcoin (BTC) with a 20% stop loss order for a 2% price drop.

- Position Size: Set up a position size ratio to limit your potential losses.

- Market Analysis: Monitor market trends and news to identify buy or sell opportunities.

Take Profit:

Once you have reached your desired profit level, it is important to place a take profit order to lock in your profits. This can be done by:

- Create a Take Profit Order: Set up a take profit order at a fixed price point above your entry price.

- Position size: Adjust position size to limit potential losses during market volatility.

Conclusion

Crypto trading can be a lucrative and exciting way to invest in digital currencies, but it requires discipline, patience, and a solid understanding of the markets.