ประเภทหนัง

ตัวอย่างหนัง The Importance Of Liquidity Pools In Cardano (ADA) And Risk Management

The importance of a kardano liquidity base (ADA) and risk management

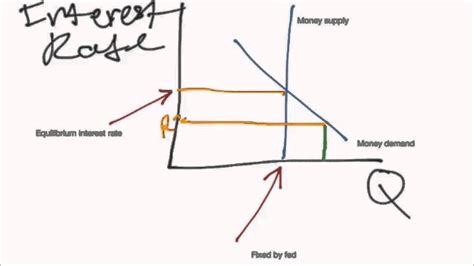

In the constant developing world of the cryptocurrency currency, maintenance of liquidity is crucial for the long -term success of any investment. This includes not only traditional property such as Bitcoin and Ethereum, but also newer projects like Cardano (Ada). In this article, we will enter into the importance of a kdano liquidity base and risk management strategies to help investors move to the complex landscape of the Crypto Currency.

What are the pools of liquidity?

The liquidity pool is a decentralized platform that allows users to deposit property with lower volatility or greater liquidality, while receiving the opposite property (ie, assets with greater volatility) back as a fee. This concept launched Makerdao in 2016, which created a decentralized Stabblecoin called Dai. Today, liquidity pools are used in various forms in different blockchain networks.

Cardan’s liquidity pool

In Cardano (ADA), the ecosystem defined (decentralized finances) relies greatly on the pools of liquidity pools to facilitate the activities of borrowing and borrowing. The most prominent example of this is the token Adausd (Adausd), which allows users to borrow Ada at a lower interest rate from a direct purchase.

Why the pools of liquidity are important in Cardano

Pools of liquidity have become an essential component of cardano ecosystems for several reasons:

- Increased adoption : by providing platforms for liquidity providers (LPS) and borrowers, Adausd makes it easier to increase token adoption.

- Improved market efficiency : Pools of liquidity help increase participation in the market by encouraging users to participate in the market. This leads to more precise predictions of prices and reduced volatility.

- Reduced risk : By creating a secondary liquidity market, Adausd reduces systemic risk associated with traditional borrowing protocols.

- Increased safety : Using a liquidity base adds an additional layer of security, as it encourages users to safely hold their property.

risk management strategies

In order to alleviate risks associated with Cardano ecosystem, investors and traders should consider the following strategies:

- Diversification

: Spread your investments in multiple assets within the definition of ecosystems to reduce exposure to any individual token or protocol.

- Investment

: Investing your Ada Token may be provided by passive income, while helping to secure a network through the investment of the rewards.

- Mining liquidity : Participate in a liquidity pool, such as Solan’s AMM (automated market manufacturer), to earn a stake in all awards generated by the protocol.

- Portfel Optimization : Refer to and re -balance your portfolio to ensure that it stays aligned with your risk tolerance and investment goals.

Conclusion

Liquid pools have revolutionized the way investors communicate with Cardano’s definal ecosystem. By understanding the importance of liquidity in Cardanou, traders can better move on the complex landscape of the cryptocurrency market. In order to reduce the risks associated with the ecosystem, it is crucial to diversify your portfolio, get involved in investment activities and participate in the ability to excavate liquidity.

Further reading

* Cardano Whitepaper : A comprehensive examination of Cardano protocol and its definition of ecosystems.

* MakerDao Whitepaper : MakerDao Stablecoin testing and his role in the DAI ecosystem.

* Define pulse : a platform that provides information, news and insights into decentralized financial space in real time.

Waiver

This article is only for informative purposes. Investing in a crypto currency has significant risks, including but not limiting to the loss of the main, liquidity risk, regulatory changes and other factors.