ประเภทหนัง

ตัวอย่างหนัง Stop Loss Orders: Minimizing Risk In Trading

Orders for stopping: minimizing driving cryptocurów

As Kryptocur increases, digital assets become available and demanding. Since prices are quickly caused by market forces, drivers are increasingly looking for the management and maximization of prosecutors. One effect for the minimum risk of minimizing ordering LOP (SLOS) in cryptocurrency trading.

What order for stopping?

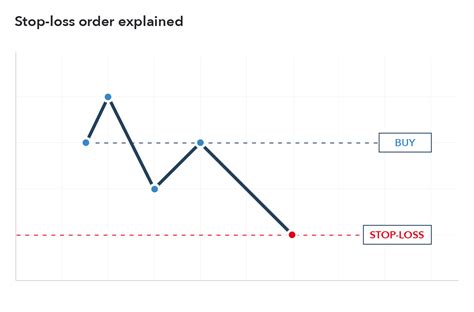

Ordering a loss is a type of order placed with a broker or stock market that instructs them to seal a certain price level just before the price of the price. The goal of SLOS is to limit them by bustling, fat fats, but prices below the level, thus limiting possession.

Why are orders for losses essentially in cryptocurrency trading?

Cryptocomist markets may die highly unstable in various underwater factors on the market, regulatory changes and external events. WOR does not use the risk of stopping loss orders in its entrepreneurs, price drops are significantly. Slos helps milestone, providing a buffer at the price level and a certain target target price.

How to configure the order of stopping loss in cryptocurrency trading:

To configure the order of loss of loss, follows:

1

2.Create a commercial account *: Register to the Broker’s account and fund et ut ut Twit Twit Twitch.

- Configure the trading platform : Download and install a trade platform with a device (e.g. Metatrader, TradingView).

- Place an order or limited order : use the trading platform to place a market order for cryptocurrency assets. Choose “Stop Loss” as a kind of order.

- * Set a step and quantity step: Enter the target price (Stop-Loss) and quantity (position size). Adjust the consent of risk tolerance and market analysis.

Best practice of configuring the order STOP LOP: *

To maximize the SLOS effect:

1.

- * Adjust the steps dynamically: re -balance and applications based on chains of market conditions and adjust the stamp prices.

- Conder Use security strategy

: Combin SLO with technical management, subsidies.

Exemple Use:

Suppy with Bitcoin (BTC) with a broker, which offers a loss function. You have 100 BTC each $ 10,000 and you want to configure a stop order to seal assets of assets up to USD 8,500 or lower. The STOP-LOSS price is 9,250 USD, and the size of the item is 1/2 of the general position. From the front configuration:

- Bitcoins price will drop to USD 7,900 (Spe-Loss level), you will be locked in currency.

- You sell yourself on assets, limits target prices (USD 8,500).

- The remaining exhibition was in a one -off analysis of the market analysis, she threw out the signal.

*Application:

Orders for loss in the inclination are an indispensable tool for farmers dying to minimize the risk and maximize prosecution in cryptocurrency markets. By distributing how slos and nourishing the party work, you can use the fluctuation power of ordering stamps using vertical fluctuations. Remember to remain adaptive, because market conditions are rapidly changing Jen, requiring constant adaptations to the strategy of ordering for losses.