ประเภทหนัง

ตัวอย่างหนัง Tether (USDT), Market Signals, Perpetual futures

“Risk Mitigation: A Guide to Cryptocurrency Market Signals and Perpetual Tether Futures (USDT)”

As cryptocurrency markets continue to fluctuate wildly, it’s important for traders and investors to stay informed and adjust their strategies to navigate the complexities of the digital asset space. One popular option that offers a unique combination of security and flexibility is Tether (USDT), a widely recognized stablecoin with a solid track record.

Market Signals: What You Need to Know

Before diving into perpetual futures, it’s crucial to understand market signals that can help you make informed trading decisions. Here are some key indicators:

- Trend Analysis: Look for trend lines and support/resistance levels on price charts. Tether (USDT) is trending relatively steadily with some occasional deviations from the mean.

- Volatility Indices: The VIX or Invesco S&P 500 Volatility Index can provide insight into market sentiment and volatility. While they are not directly related to USDT, it is important to consider these factors when deciding on trading strategies.

- Chart Patterns: Look for chart patterns such as Head & Shoulders or Triangle formations. These can indicate potential buy or sell signals.

Perpetual Futures: A Deeper Dive

Perpetual futures offer a unique combination of flexibility and security, allowing traders to hedge against market risks without having to worry about additional margin calls. Here’s what you need to know:

- Futures Contracts: Perpetual futures contracts are designed for large, fixed amounts of capital. They provide an alternative to traditional spot trading.

- Margin Requirements

: Unlike spot trading, perpetual futures require a minimum deposit (e.g. 2x margin). This means that traders must be prepared to absorb potential losses or hold their positions.

- Leverage and Risk Management

: Perpetual futures involve the use of leverage, which can magnify both profits and losses. Traders must develop effective risk management strategies to mitigate risk.

Pegged (USDT) Considerations

When choosing a stablecoin like Tether (USDT), consider the following:

- Security: Tether (USDT) is renowned for its security, as its value is pegged to the US dollar.

- Liquidity: The USDT market is highly liquid, with many liquidity providers and market participants.

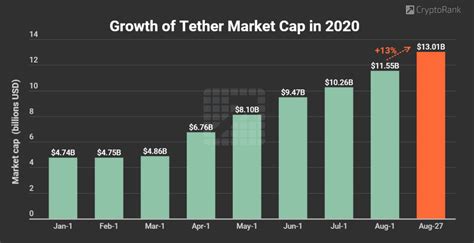

- Market Cap: The total supply of USDT is capped at 10 billion tokens.

Conclusion

Tether (USDT) offers a solid foundation for traders and investors looking to manage risk or profit from cryptocurrency. By understanding market signals and utilizing perpetual futures, traders can increase their chances of success. However, it is important to approach these strategies with caution and develop a clear risk management plan.

Additional Resources

For more information on Tether (USDT) and perpetual futures, we recommend exploring the resources below.

- Tether (USDT) Official Website: [www.tether.com](

- Perpetual Futures Trading Platform: [www.perpetualsworld.com] (

- Cryptocurrency Market Signals and Strategies: Explore various books, blogs, and online forums dedicated to cryptocurrency market analysis.